Orders within the EU

As of 1 July 2021, updated EU VAT rules for business-to-consumer (B2C) transactions will apply. We, therefore, charge Value Added Tax (VAT), of the Standard rate, set by the country/state the product is to be shipped.

You can also find the tax rates of each EU country listed here.

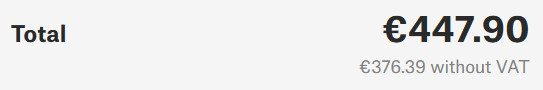

You will see the price with and without the VAT amount (tax) during the checkout

Business-to-business (B2B)

You can receive the invoice without VAT if you have a valid EU VAT number. Check the option "I'm shopping as a company", and fill in the Identification number and the EU VAT number. The validity of the VAT number is always checked by the VIES VAT number validation engine.

Make sure to fill in all the fields correctly and confirm that the total amount in the order does not have the VAT. If you believe that all information has been entered correctly and the system still shows an error, please check that VIES VAT number validation system is online or contact our LiveChat for help.

The VAT number must be written in the format shown in the picture above, otherwise, it will not be taken into account by the system.

Business-to-business (B2B) VAT refund

If the order is paid with the VAT included, it is not possible to refund just the taxes from the order through the e-shop. If the order has not been shipped you can cancel the order before it is shipped. You will receive a full refund, and be able to make a new order without the taxes added. If the order has already been shipped, it is possible to request a refund in your country:

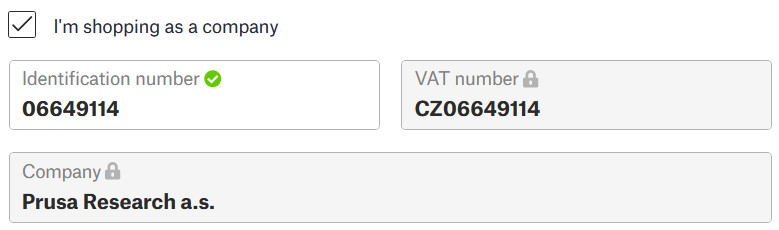

Orders outside the EU

For other non-EU countries, if your order is processed via Global-e, the local taxes from your country will be calculated during checkout. For some countries, it is possible to pay the fees only on delivery. In this case, customs fees will be collected when your package arrives in your country. If this is possible for your country, the option will be above the payment options. If this option is not shown, the option to pay on delivery is not possible for your country.

HS codes

Different products have different HS (Harmonized System) codes. They are designed to be consistent internationally, with the first six digits standardized by the World Customs Organization (WCO). These six digits are used universally to classify goods and determine tariff rates, ensuring that all countries recognize the product in the same way. However, beyond these six digits, countries can extend the codes to eight or ten digits to meet their specific needs.

The customs clearance process has to be done on the customer's side, with the help of the customs broker they get from their carrier (DAP incoterms).

| Product Type | HS code |

|---|---|

| All printers | 84852000 |

| Spare parts (includes MMU and CW1/S) | 84859090 |

| Filaments | 39169090 |

| Resins | 39073000 |

| Fire suppression system | 8424100090 |

| Printed book, brochures, leaflets | 4901990000 |

| T-shirts (merch) | 6109100010 |

| Hoodies (merch) | 6110209900 |

| Beanies (merch) | 6505009090 |

| Snapbacks (merch) | 6505003000 |

Tariff FAQ

Tariffs & Customs

Q: Are the new tariffs going to affect my order?

A: Yes, unfortunately, the new US tariffs are taking effect. If your order ships after the enforcement date, it may be impacted.

Q: Will there be an extra cost I have to pay, or is it included in the price?

A: Starting August 7, 2025, for orders bound to the US, there’s a 15% universal tariff on all imported goods. These charges are included in the price when paid through Global-E, so no extra tariffs should be added.

Order Cancellation & Changes

Q: I want to switch to a kit version to reduce costs. Can I do that?

A: Absolutely! You can cancel the current order and place a new one for the kit version.

Q: I decided to buy from another vendor. Can I still cancel?

A: You have the option of cancelling the order directly in your account if the order has the "New" status. Please consider ordering from Printed Solid, our official distributor in the United States.

8 comments

Exchange rate USD-COP

3.750 COP

Value of shipment in USD

$ 950,00

C.I.F. (cost, insurance, freight)

3.562.500 COP

Gravamen Arancelaria

356.250 COP

VAT (IVA, 19%)

744.563 COP

Import duty

1.100.813 COP

Additional logistic provider fee (est.)

74.456 COP

VAT over addtional fee (est.)

14.147 COP

Sum total

1.189.415 COP